- This event has passed.

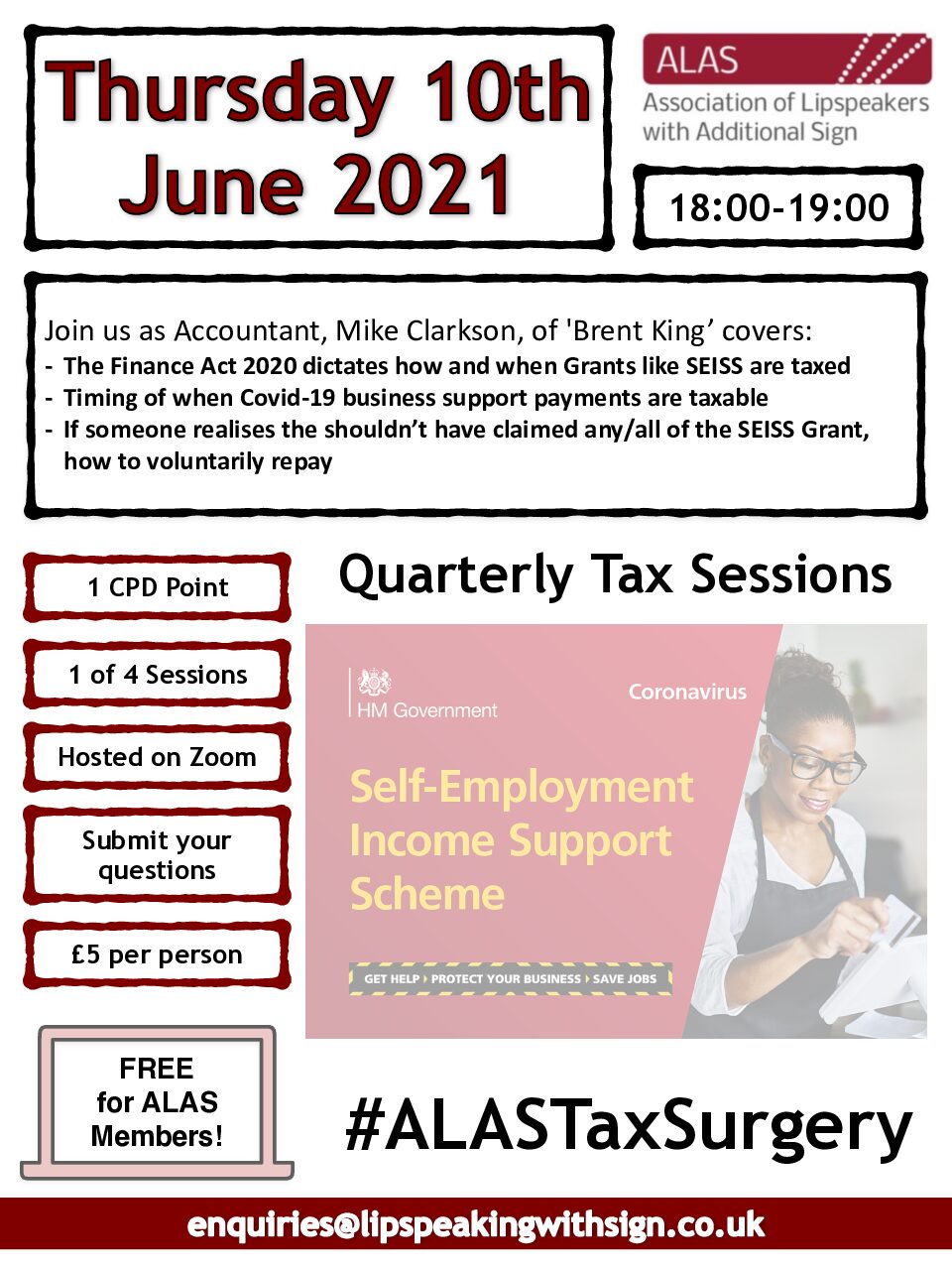

Tax Surgery – Taxability of the Coronavirus Business Support Payments: When and how much for sole trader businesses?

10th June 2021 @ 6:00 pm - 7:00 pm

£5

Join us for a tax session with Mike Clarkson FMAAT FCCA Director at Brent King Chartered Accountants, who will cover:

- Timing of when COVID-19 business support payments are taxable (this is of particular importance to sole traders!).

- The Finance Act 2020 dictates how and when Grants such as (but not limited to) SEISS, Business Support Grants etc are taxed.

- If someone realises they shouldn’t have claimed any/all of the SEISS Grants, how to voluntarily repay any overpaid SEISS.

This event is free to ALAS members and £5 to non-ALAS members.

Please register your interest by emailing [email protected]

Non-ALAS members, please also make a £5 payment to:

ALAS

Sort Code: 20-11-43

Account: 63389839

Ref: (TAX Your Name)

All joining instructions will be sent on Thursday 10th June.